How to build an Airbnb Business: Rapid Fire Q&A: Your STR Questions Answered

We get quite a lot of questions and the topics range. I try to lump them together and create a podcast for the ones we get asked most often but I thought it would be fun to do a rapid-fire Q&A for this week’s episode.

The real world is much like school was when we were growing up – we often don’t ask enough questions. And the only way we can become comfortable with what we are doing is by uncovering the answers and diving deeper. So I encourage any of you who have been listening in over the last couple of years to let us know what’s on your mind!

And hopefully this week we will be able to answer some of the questions you *wanted* to ask.

No question is a stupid question! This weeks topics range from:

- Service Animals and our right to refuse them

- Lease arbitrage

- Airbnb Tax reporting

- Enforcing Min age restrictions on different rental websites

So, whether you’re a seasoned real estate investor or just starting out, whether you’re intrigued by the opportunities of short-term rentals or simply seeking financial freedom, I hope you will find this episode helpful.

I’m excited to announce the dates are out for our upcoming virtual event! We’ll be meeting with a panel of industry experts where you can get your questions answered.

We’ll follow that up with a remote management workshop where we’ll unveil every system our company uses, how you can use the same ones, and EXACTLY how to actually set them up.

You can find all of our links here including our recommended resources, short-term rental playbook, Instagram, and more!

Click Here to view Transcript

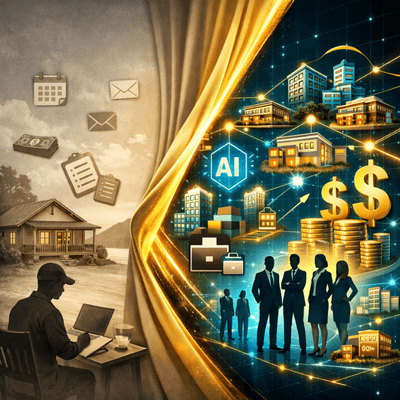

When I first got started investing in real estate a long, long time ago, I had a ton of questions. I was nervous. I was scared. And when I first dove into short-term rentals also a long time ago, I had the same feelings. Now after acquiring dozens of properties in and outside of the U.S. and also managing other properties with my amazing team from the Philippines, from Mexico, from Europe, from the U.S., we’ve got a ton of experience now and we get a lot of questions from you guys’ coming in. So, I’m excited to answer a few of those today on the Short-Term Rental Riches podcast.

Welcome to short-term rental riches. We’ll discuss investing in real estate but with a specific focus on short-term rentals. Quick, Actionable items to Acquire, Manage and Scale your portfolio. I’m your host Tim Hubbard.

Welcome back to the show. There is no such thing as a dumb question, right? We heard this a lot growing up in our schools, but I know that we’re still oftentimes nervous to ask questions, right? We don’t want to feel dumb or stupid or anything like that. Luckily with YouTube and with all the social media out there, we get a lot coming in. And so, I want to take a moment today to answer some of those great questions coming from you guys. If you haven’t tuned into our show before, make sure to check us out at strriches.com. You can see all of our prior episodes there. You can also see our videos if you’re not catching this on YouTube, or you can catch our podcast there. Subscribe to whichever channel you prefer. Let’s go ahead and jump into it.

The first question we’ve got coming from Jack. He says, I have a service animal and in Texas, the owner at the Airbnb where he stayed or short-term rentals said, while we love our four-legged friends, we do not allow pets in our home. We have a strict policy to ensure our home is in perfect condition for all of our guests. We have a short time to make sure our home is clean for our next guests. So, we’ll likely need to hire additional help to take care of any pet hair left behind. Also, we try to make sure all of our guests with pet allergies are taken care of. We would kindly appreciate it if you can make other arrangements for your pup during your stay. We hope you understand. And Jack’s asking, can an owner actually do that? So, this is in Texas. And the answer is, it depends. As we know, real estate and landlord laws are different in every state. And of course, they’re different in other countries if you’re tuning in from outside the US. But in the US, it really comes down to emotional support animal versus service animal. So, if we’re talking specifically about Airbnb, you are not allowed to deny a service animal, but you are allowed to deny an emotional support animal or ESA as it’s often referred to, except if you’re in states like California or New York. And that’s at the time of this recording, so it’s possible those rules could be changed. Again, this is according to Airbnb’s policies. They’re very strict with these types of things. So yes, Jack, unfortunately, that Airbnb owner did have the right to refuse you and your little pup for that stay.

The next question comes from one of our viewers from YouTube, and it’s all about Google Vacation Rentals. So, if you missed that episode, go back and check that out. Google Vacation Rentals is making their way into the short-term rental space. The question is, first of all, I say thank you for the video. Does Hostway sync with Google Vacation Rentals? I know Logify does. So, for those of you that aren’t familiar, Logify and Hostway, these are two different PMS programs, we call them. Property Management Software programs, and there are a ton of them out there. It really comes down to the specific program you’re using. So, something you can check easily before you sign on and start using a property management program. Just be careful though, as we know, Property Management Software programs might integrate partially with an OTA like Google Vacation Rentals or like Airbnb, but there may be some things that it cannot do. So that actually leads me to the second part of the question. It says also, can you charge your guests by the month, or does it make you charge them all up front before they move in? We do monthly rentals, they say. Google Vacation Rentals is basically just another advertising avenue to lead people to book directly with you. So, it really comes down to what you want to do. I recommend charging up front. That’s what we do with all of our rentals and with all of the rentals we manage. Yes, we are helping to manage other properties now virtually. If you are looking for some help, check us out, strriches.com. There’s a property management button there. I’d love to meet with you personally to see if your properties fit in with our portfolio. But this all comes down to the way you want to handle your listings. It’s basically another advertising site to help you get a little more exposure. So, I think that’s pretty cool.

All right, next question comes from Sean Burkholder. He says, I have a question. In the video, you mentioned leasing an apartment and doing Airbnb with that. Is there a specific criteria you like to see before leasing an apartment in that way? What Sean’s referring to is lease arbitrage. And now while I like to invest, that’s my main gig. That’s where I started and that’s what I continue to do. And I’ve built a pretty good portfolio, as most of you know. I do have some properties that I’m currently leasing and doing the lease arbitrage model. They sort of just fell into my lap and it’s been over two years now since my team and I have been managing those. They’ve done really well. And so, we’ve done a few episodes on that. For those of you that aren’t familiar with lease arbitrage, you can go back and check out the episode 72, episode 71 and episode 103. So, we’ve talked about that quite a bit, but that’s basically when someone leases a property, they have the right, so this has to be in your lease, to sublease that property on Airbnb, for example, or to short-term rental guests and then make the difference. So, for me, that’s worked out really well. And we talk about the specific terms in those prior episodes, but I’ll just give you the highlights. The things that you want to make sure is that your lease says you can in fact sublease. I think the longer the lease, the better. That way the owner doesn’t decide to do it themselves or you don’t buy all the furniture and realize that you can’t do it after year one because whatever happens with the lease, they don’t get it renewed. You definitely want to be careful with this. I would say that it’s risky, but one of the things a lot of people have a down payment to buy the actual property, but remember you’re also not building equity too. So, it’s not really a true investment. It’s a way to generate great cash flow. It’s a way to learn the short-term rental world. But at the end of the day, we want to be building some equity. We want people to be paying down our properties for us, right? That’s the name of the game. So, check out those prior episodes 71, 72 and 103 if you miss those and we go into lease arbitrage in more detail.

I’m excited to say that we just announced the dates for our next virtual event. It’s going to be October 14th. We’re talking about margin mastery, how we can make more money with our properties that we currently own. And there’s a lot of ways to do that. My team and I have been doing that, perfecting that with our properties and other people’s properties. As you know, we’ve managed tens of thousands of guests. We’re always looking at the latest and greatest tools and we’re using them as well. So, if you’re interested in that, head over to restmethods.com. You’ll see it right under events there. We’d love to see you there. It’s going to be jam-packed. It comes with tons of our checklists and things like that that we use. And we’re going to go deep into pricing. We’re going to go deep into maintenance. We’re going to talk about VA’s and how to hire them and best practices and give you the scripts and just going to be jam-packed. So, I hope you can make it. And I love to hear the questions there live as well.

Okay, another question from our YouTube channel, Short Term Rental Riches. Question says, is providing a few K-cups and a few snacks considered an active business? So, this is in regards to taxes and our taxes change when we have an active business versus a passive business. Traditional long-term rentals are passive, right? But an active business like running a laundromat, for example, these have different tax consequences. I am not the expert. I am not a CPA. But we have had excellent advice on the show. You can go back and check out episode 156 and 157 with Tom Wheelwright. That is Robert Kiyosaki’s accountant. A lot of us have heard about Robert Kiyosaki, right? He wrote The Rich Dad Poor Dad. And he runs an amazing, amazing company, a massive network of a lot of resources. And in there, we have a webinar with my CPA. And she goes in depth. It’s a recorded webinar, totally free. You can check it out. And she talks about the difference between active and passive and what’s considered active and passive and just some things that we need to be weary of with our short-term rentals. So, I am not a tax advisor. But from what I understand, when we’re an active business. So, in this question, where it says providing a few K-cups or snacks, so K-cups are like the Keurig coffee cups, if you’re not actually charging for those, then I would say no, but make sure to check with your tax advisor or check out some of our prior content.

Next question, this comes from Seth Weinman. Hopefully I pronounced that right. Says, so far as I am aware, Airbnb does not allow you to set an age limit or age restriction to make a reservation. As long as you’re at least 18 years of age and provide a valid ID, you can book an Airbnb. Is this in fact the case? On vrbo and booking.com, I have an age restriction set to 25. But apparently on Airbnb, it’s just 18. Yes, Seth, this is the reality. We have in our house rules, and I recommend you might want to do this as well, to where it says our minimum age for most of our booking sites like vrbo and booking.com where we’re allowed to set a minimum age. Our minimum age is 23. But what we do on Airbnb is we have a rule in our house rules that says if you’re younger than 23, please notify us in advance of your reservation. So again, this can’t be enforced with Airbnb, but at least it’s something that our potential guests are seeing. And a lot of times they will reach out just to clarify, yes, I’m 22, but I’m coming to visit my mom who I haven’t seen in a college or whatever it happens to be. So, it can’t hurt to ask. Doesn’t mean that everyone’s going to answer it, but it is one little tip that you could do to include it in your rental agreement. So, our big worry with minimum ages is that, you know, they might not take care of our property and they might damage it. So of course, we want to make sure that we have the proper protection for our property in case that does happen. We want to have security cameras on the exterior to make sure they don’t show up with a whole bunch of people or pets when we don’t allow pets. But we need to make sure our house rules are really well defined, what’s allowed and what’s not allowed.

Next question comes from Namrada. Hopefully I’m pronouncing that one right. She says, I live in Seattle. I’m a physician. I have two young kids. I need to invest to quit my nine to five to get more time for my family. This is one of the amazing things about real estate, right? That’s why I got into real estate a long, long time ago. And that’s why a lot of us do. We can set up all these systems, including with our short-term rentals, passive systems where we can remove or outsource most the responsibilities, get back that time so we can spend it with the ones we love, our friends and experiencing the world. So, she says, biggest question, which market to invest in in this high interest rate will earn the highest COC return? So, COC, that’s cash on cash. This is the question of the day. I mean, this is a tough one and this is the most common question that we always get. I can just give some basic guidelines around this and my personal opinion. I would say in this current market that affordable markets are going to be some of those that are going to outperform the more expensive markets like Seattle, Los Angeles, Miami, those types of markets, because more people are moving to those markets. So, we have a higher demand going to these places like Florida, like Texas, like Tennessee. Of course, within each of these states, there’s going to be cities that are much more affordable than others, but affordability is driving people into markets. And if you’re entering into affordable market, well, then that means your purchase price is going to be lower as well, right? Generally speaking. And so, if we can acquire property at a lower price in a place that’s getting more demand, which will drive up rents, that means our cash-on-cash return should essentially be higher, right? Now we have to be careful with this. So those places that I just mentioned, for example, Texas, Florida, tons of great markets here, but we also have changing expenses. So, if you’ve got properties in Florida, well, then you might have come across a much higher insurance bill recently than you did in the near past. And if you’re in Texas, well, you might be paying much higher property tax than you did in the near past. So, we just did an episode actually on property tax and a little bit on short-term rental tax. That’s episode 192. If you missed that, go back and check it out because you might be able to save a little bit on your property tax. I would say, Namrada, really the affordable markets, they’re going to have lower acquisition prices. And if we choose the right ones, then we’re going to have more demand going there, which should boost our rents and should boost our returns. We got to be careful that we’re not getting into a market that has much higher expenses than it did recently. So that would be my answer in a nutshell, but this is a tough one to answer. If you think you’ve found the affordable market, well, the best thing to do is just run potential numbers, run potential cashflow numbers and compare that with another market. That’s going to help you make a decision.

I hope you found this episode helpful, a little insightful. If you have any questions, let us know. I love to answer questions. Just head over to strriches.com. You can scroll down. There’s a place where you can post a question, post a topic if you want us to do a whole episode on it. And I would love to hear from you. If you’ve been enjoying the show, I would really appreciate it if you wouldn’t mind heading over to iTunes or Spotify, or if you’re watching this on YouTube, just leaving us a like, leaving us a comment, subscribing. And until next time, I hope you have a fabulous week.

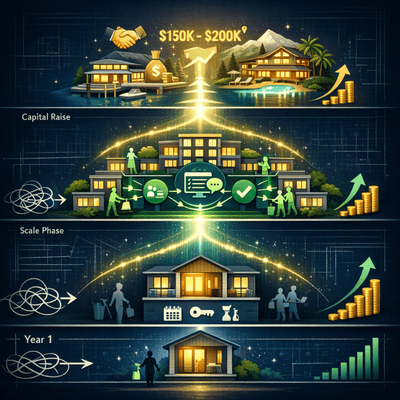

Want to get on the fast track to Financial Freedom through short-term rentals what all starts with the properties you acquire but you want to make sure that you acquired the right properties. I want to give you my e-book that will show you how to do just that. There is no charge, It’s my gift to you for being one of our subscribers. Just go to restmethods.com. That’s R-E-S-T methods.com

RELATED PODCAST EPISODES