How to build an Airbnb business: In Uncertain Regulation Changes! Must-Have BACK UP Strategies.

Short-term rental investing is a relatively new concept and as a result cities, counties and states don’t quite know how to handle it. There are literally thousands of different regulations around short-term rentals. So, what do you do? How do you know your short-term rental investment is a good one and a SAFE one? Find out the best strategies so that no matter what happens you will be making a sound investment.

- Properties that make sense from day one

- What if the economy crashes?

- Focusing on extended stays

- Commercial zoning

- Obtaining a license to operate

For more visit restmethods.com

Welcome to short term rental riches will discuss investing in real estate but with a specific focus on short term rentals quick actionable items to acquire manage and scale your portfolio I’m your host Tim Hubbard.

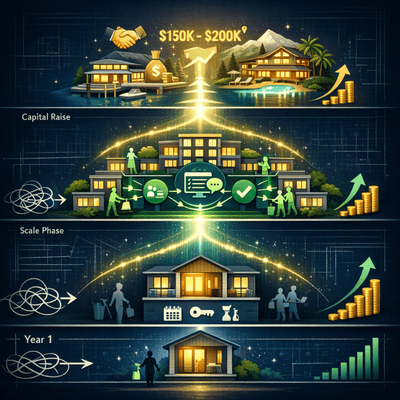

Welcome back to the short term rental riches podcasts I’m happy you’re here again and that today we’re gonna talk about something that it’s very important perhaps the most important piece about mess in real estate and that is having a backup plan and when word looking to invest in a property to convert it to a short term rental it’s essential that we have backup plans especially if we’re in an area where the regulations are still unknown if they’re in a great area and it’s possible that they could change so I hope in this brief episode I can help alleviate some of the unknown for you take the fear out so that you guys can pull the trigger faster acquire more properties and feel comfortable about the properties that you’re buying because you know they say don’t wait to buy real estate buy real estate and wait so let’s get right in let’s talk about my 3 backup strategies and also kinda we even you know what happens if the economy crashes especially in today’s environment there’s a lot of fear out there about there and rightly so for many reasons so my first backup strategy number one is just to simply start off purchasing or acquiring a property that makes sense the day you buy it.

And how do you know that it makes sense today by well it cash flows with a long term tenant we’re talking about residential properties here and even if that property is vacant you can still find out what long term rents are in the area just as you can get a good idea of what the short term rents are now with all the tools available but you know basically what the long term rents are in there and the rough expenses so it’s fairly easy to calculate whether or not that property would cash flow with the long term tenants in there now if it doesn’t I would say don’t do it the other thing is that if you’re requiring a property as an investment with long term tenants the financing is going to be a little easier for you verses you’re going to a lender and saying Hey Mr Mrs lender would you loan me X. amount of dollars for this property I want to convert into short term rentals in its can do really well now it may do really well but the lender doesn’t have any history on the short term rents in that area most lenders chin I say there are some popping up now for short term rentals so let’s just start off from day one with the property that makes sense the day by now this is most likely not going to be an a vacation rental area those properties tend to be more expensive and they also tend to just cater to people invocation short term gas so what happens if the economy takes a nose dive well a lot of people cut out occasions the super wealthy probably don’t because they’re super wealthy and it just doesn’t matter but the middle class that’s one of the first things ago when an economy takes a dump so if you’re in an area where you bought a property that made sense as a long term rental it’s also most likely not going to be in a class property of super.

Prime property because the numbers usually don’t work on that the property would be too expensive for the amount of rents it’s getting so if you’re buying a mediocre property but that’s still in a good area what happens if the economy crashes well all the people that are running these really expensive apartments in their leases and they move to more affordable apartments so I highly suggest if you’re looking for new properties keep an eye out for the ones that makes sense the day you buy am I in the in that sort of B. area this is going to be safe for you if the economy crashes as well and these properties also allow you to get some of the biggest returns when you do convert them into short term rentals so that’s the exciting part about it but we’re talking about backup plans today so find that probably makes sense the day by it will secure you for the long run now when I say backup plan I’m really talking about having alternative options for your property before you even buy it so it’s it’s more of a pre planning.

The backup plan I guess if that makes any sense at all it’s just having more options with your property if you’re buying it specifically for short term rental in the short term rental market changes then you could find yourself in a little bit of trouble but if you find a property that makes sense for the long term tenant you can always go back and put a long term tenant in there if the short term rental regulations changes prevents you from doing that or if the supply increases too much you’re still going to have a good property at the end of the day.

Now number 2 what is your second backup plan if the regulations change in the city let’s say your property’s already converted you’re already operating as a short term rental what most the time these cities create regulations that say a short term gassed is defined as someone that stay less than 30 days so you can simply not read to people for less than 30 days and you can focus or target on someone that needs an extended stays of 30 days or more. One of the beautiful things about this.

Is that you also don’t typically have to pay a transient occupancy taxes which you do most the time for stays less than 30 days you’re also gonna have less expense less turnover less messaging so that is a good option to in fact if your short term rentals in an area that already has some demand for these extended stays you might want to consider trying to make that a larger percentage of your guests stays okay lastly backup plan number 3 and this is really a backup plan before you bought the property these are strategies we can use to protect ourselves for the long run to make sure when things change when the economy crashes if it does or if there’s a down turn or short term rental regulations change these are strategies we can use to protect ourselves to make sure that we still have a good investment so number 3 is to find a property that’s either already zoned for transient occupancy which would be similar to what a hotel is and this would be a commercial zoning lot of times you can find these properties in downtown areas I like to look in mid town areas.

And a lot of these properties will have mixed use zoning so meaning it could be a residential property it could be a small 4 plex building or maybe there’s 3 apartments but then downstairs there’s a commercial property there’s a store there so has mixed use zoning and this is gonna be a lot easier for you to secure a special use permit to operate that property is a short term rental if the regulations change.

So that’s one way for just find a property that’s zoned commercial the other way is to find a property that already has a short term rental permit or find a city or a market that is open to it it’s already passed laws so there is no gray area you already know what to expect and then still just make sure you’re finding that property that that cash flows even with long term tenants because you never know the supply.

Could really increase and your short term rental returns could go down.

But by having that permit especially if it’s an area where there’s a limited amount of permits and your property already has one that’s gonna be a really great find and that could work out really well no a lot of vacation areas allow all the properties in these vacationers to rent short term but those properties again if we go back to number one are usually more expensive and they can get hit a little harder if there’s a downturn in the economy so just to recap the 3 backup strategies that you want to keep in mind that you want to focus on if you’re finding new properties number one just make sure you find a property that makes sense the day you buy it number 2 if the regulations change you can go back to running to an extended stay guest number 3 is fine in that property that’s already zoned commercially or already has a permit to operate as a short term rental.

So I hope that helped there aren’t tons thousands of properties out there that are great properties that will work exceptionally well the converters short term rental and if you just keep these 3 backup strategies in mind and find a property that fits into one of them then you’re going to be pretty safe for the long haul thanks for joining me again look forward to talking with you next time.

Want to get on the fast track to financial freedom through short term rentals little search of the property you want to make sure that you acquired the right. I want to give you my you do the washing just that there is no charge my gift to you for one of our subscribers just go to rest methods.com R. E. S. T. methods.com

RELATED PODCAST EPISODES

- Episode 61: Pro Tax Advice directly from my CPA (part one)

- Episode 48: How to Determine if You Will Do Well in a NEW Market

- Episode 38: Is a Short Term Rental the Best Use for Your Real Estate?

- Episode 19: Where do we stand in the current crisis?

- Episode 14: When Recession Hits, Will You Be Safe?