How to build an Airbnb business: What is the Best Real Estate Market?

There are hundreds of large MSAs (metropolitan statistical areas) and different markets that comprise the whole real estate market and each of them are unique. They have different growth rates, investment returns, laws, etc. How do we narrow down the BEST ones without doing ALL the research?

- Discover the shortcuts to finding good markets

- Why do these markets make sense?

- The fundamentals of a strong market

- The sun belt, baby boomers, demographics

- Rent-to-value ratio (rent / purchase price = RTV)

- EXAMPLE: $1,000 monthly rent / $100,000 purchase price = 1% RTV

For more visit www.restmethods.com

Welcome to short-term rental riches will discuss investing in real estate but with a specific focus on short term rentals quick actionable items to acquire manage and scale your portfolio I’m your Tim Hubbard.

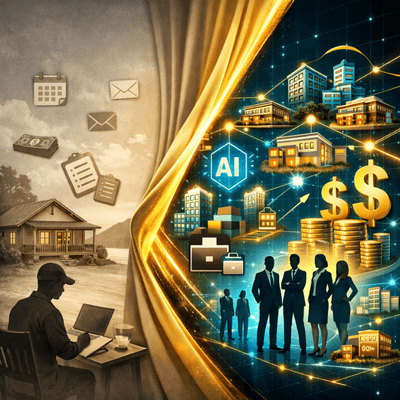

Welcome back to the short-term rental riches podcast another great episode for you today maybe the first thing you should ever think about before purchasing a property and that’s whether the market makes sense that’s what we’ll discuss today is how do we find that market because there’s so many and the U. S. and around the world and they’re all very very different and they’re all appreciating at different levels they all have different rent to value ratios they all have different returns what can we do to narrow this down on a broad level and find these markets it makes sense so that’s what we’re gonna talk about today and let’s just jump right in the beautiful thing about all of the information that’s available to us today is that we don’t have to do a lot of the groundwork and the leg work a lot of people have already done this for us there’s companies that spend hundreds of thousands of millions of dollars researching markets now they may not make that readily available but they’re certainly ways to find it and there’s people that we can follow in companies we can follow that are going to narrow the search down for us considerably much better than than we probably could on our own so what makes these markets good water big investment companies looking for Walt most all of them most big companies are they’re all looking for the same set of fundamentals those would be strong employment increasing population a market that’s landlord friendly so there’s definitely some markets that are less landlord friendly than others you know if you have a bad tenants bad resident it’s harder to have big.

Them so we want to be in a market this landlord friendly. We want to find a market that has a low cost of living and for a couple reasons 1 is the properties are most likely going to be less expensive but that’s also an area that a lot of people are going to want to move to when we have baby boomers and which is 1 of our biggest demographics here in the US they’re moving to places as a retired that cost last simply because either haven’t prepared well enough for retirement or just because they’re retired they don’t need to be in the market where they grew up or lived so they’re moving to places with lower cost of living so we have these fundamentals how do we narrow it down from there will you can use what we call rent to value ratio which essentially is the mount of rent you get back per dollar invested so you could take to properties across US let’s grab 1 in Texas and 1 in Arizona 24 plexus all you need to know is how much those properties cost and how much rent they earn on a monthly basis and then you can determine that rent to value ratio.

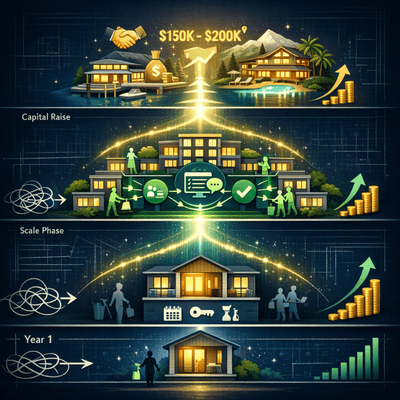

A lot of people in today’s market are striving for a a one percent rent to value ratio which you can still find a lot of places the cool thing for us a short term rental investors is that we can find these good properties and then we can convert into short term rentals and that return will go through the roof so knowing those basic fundamentals and knowing how to evaluate one property from the other. How do we narrow down this market so we don’t have to go through all the research read economic articles and you know look up city stats and all these types of things well there’s a lot of companies that are doing this already to find these properties that makes sense and have good returns you may have heard this term before with there’s a lot of it turn key providers out there especially in the U. S. and those are companies that are sensually buying properties most the time single family properties and renovating them and selling them to investor data base you’re still earning a good return on the property even though it’s in tip top shape because a turn key providers already done all the rehab but it’s still earning a good return because those turn key providers started in a market that makes sense so you can find a handful these people really easily just jump on Google type in turn key providers and you’ll start to see these pop up and the ones that offer multiple markets are almost always gonna have information on those markets as well you know statistics and about the Plymouth growth and why that makes a good market you’ll see a pattern most of these companies are investing in the same places so narrow down some of those places I suggest you just grab like 3 markets that you are interested in and that’ll really help you narrow it down from a broad level.

You will as you’re narrowing this down probably discover some trends and they’re pretty easily noticeable once you start digging and one of them is that people are moving to warmer areas they’re they’re moving to the Sun Belt at least in the U. S. down from the north down where it’s colder down where most people have traditionally lived and I found this really interesting when I was I was doing some research awhile back that part of the reason people are moving to warmer areas is as simple as the fact that now we have her conditioning in the past have you think about it in New York for example you know some of the places where we first settled in the US it was really cold but we could make it warmer with fire but we couldn’t make really hot areas colder so now that we can with the invention of air conditioning people are starting to move down in these warmer areas so you will notice that places like Florida and Texas and Arizona have really strong population grows as a result of that are great places to invest 20 near down those markets there are more steps as a short term rental investor because all those markets don’t necessarily make sense as a short term investment we’ll talk about that in future episodes but just to recap how do you break it down to some broad markets just find some people that are already broken it down just go on Google and search for these turnkey providers in the once you do and you know these markets down then you can do your own search to you know you can look up city demographics and state demographics and they will have lots of information on their cities as well just do a little digging in narrow down but that’s the first step you know find these markets that makes sense from day one and then we’ll jump in later and we’ll find the best. Properties it makes sense in there for short term rentals until next time a wonderful day. Want to get on the fast track to financial freedom through short term rentals what all searching the properties you.

You want to make sure that you acquired the right properties I want to give you my. Yes there is no charge to you for being one of our subscribers the rest methods.com that’s R. E. S. T. methods.com.

RELATED PODCAST EPISODES

- Episode 59: 6 Steps to Get Started as a New Investor

- Episode 38: Is a Short Term Rental the Best Use for Your Real Estate?

- Episode 28: Where to Find the Best Information for Your STR Business

- Episode 19: Where do we stand in the current crisis?

- Episode 04: Uncertain Regulation Changes? Must-Have BACK UP Strategies