How to build an Airbnb business: When should you put your property in an LLC?

Let’s face it, for those of us that live in the US we are living in one of the most litigious countries in the world. You’ve heard that you need to protect yourself and your properties, but what is the best way? Is it necessary to form an LLC in which to hold your property? There are multiple steps we can take to protect ourselves, but which ones are the right ones and when are they necessary?

Tune in this week as Tim answers those questions and more!

A story to illustrate when we need extra protection Having the basics: house rules, deposit, insurance, general liability policy, umbrella policies Forming an LLC and what you may not know Are you being sued?

To hear the episode on house rules tune in to episode 24 “Essential House Rules for your STR”

If you want to learn more about Tim’s journey, email us at resilience@restmethods.com for a free copy of the Amazon Best Selling book Tim co-authored: “Resilience, Turning Your Setback Into a Comeback.”

Are you enjoying the podcast? Please subscribe, leave a rating and a review, and share it! This helps us reach others that may find the info helpful as well.

You can find all of our links here including our website, webinar, Instagram and more!

Click Here to view TranscriptIn the short-term rental riches will discuss investing in real estate with a specific focus on short term rentals quick actionable items to wire. Scale your portfolio I’m your host Tim Hubbard.

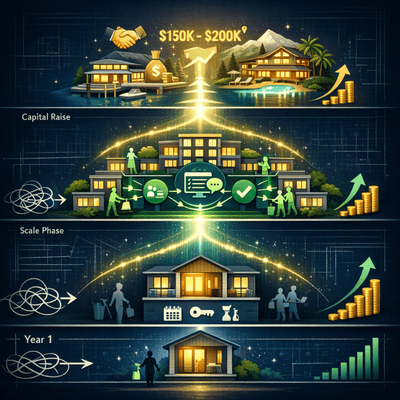

Welcome back to the short-term rental riches podcast Ste thanks for joining me again happy you’re here as always today we’re gonna talk about L. L. C.’s limited liability companies and whether we should put our properties in them or not I get asked this question all of the time so I want to give you my inside what I’m currently doing and just a couple tips and pointers to consider but first before we jump in I just want to illustrate how litigious our society that we currently are living in this and I’m referring mainly to the US although some western countries are also becoming more more litigious but I think we all know that lawsuits are an everyday thing in the United States I have a a good buddy of mine that is a lawyer for home depot he was I should say he opened his own practice good for him but he was a lawyer for home depot and represented the state of California she told me that every single day they got sued in California but by their own employees we’re talking about just their own employees they got sued every single day and what did they do they settled because if they get into a lawsuit it drags out a whole bunch of stress and and it’s just not fun for anyone so they settled and they just paid a lot of people out isn’t that crazy though every single day they were getting sued by their and that’s just their own employees so we live in a very litigious state and we need to protect ourselves we’ve talked a little bit about. Some of these things in the past in prior episodes one was on house rules so if you haven’t gone back make sure you listen that possible legal link in the show notes but that’s the first step and then there’s a couple other steps there that are super super important deposit and then insurance is very very important but we’ll have to do a whole episode on that because there’s a lot of things to consider but just real briefly if you’re looking for short term rental insurance specifically I use proper insurance on some of my properties not all of them and still converting over to them it is expensive but they cover you and they specifically ensure short term rentals some your normal policies State Farm farmers they may say they do the agent may think that they do but if you read through the policy you may find out that they don’t and so you will be very very careful without but we’ll get into that in another episode today I want to talk about limited liability companies which is another step of protection because it’s limiting the liability between you and a potential lawsuit essentially you’re taking your property or your assets and holding it in another company now most people use limited liability companies because they’re easy to set up and a lot of times they’re inexpensive so I use a lot of L. sees I have multiple sometimes I own several properties under one depending on the size of the property and may have just one property under its own L. L. C. I kinda give just a bench mark if you’re considering putting the property in L. C. I think it may not be necessary it’s totally up to you but I just use this as a benchmark if you have about $1000000 worth of property or more than I consider putting it in an L. L. C. now that’s. Just my opinion depending on where you’re setting up the LLC it could be very inexpensive a Wyoming is often talked about as one of the best states to set up an LLC I have a Wyoming I’ll see myself but if you’re putting your property under an LLC you’re gonna have to talk with your lender if you have a loan on the property most of the time actually they require that you have an L. C. and the state in which your property is so if you’re in California they’re probably gonna want to California L. C. if you’re in Oklahoma the Prague and one in Oklahoma L. L. C. so just take that into consideration and and most of time we put our property in L. C. it’s one more requiring that so that’ll be an easy question for your lender and let them know and then when you’re actually acquiring the property on your purchase agreement you want to write that the purchase is being made by yourself and or assignee and the signee is going to be in the L. L. C. company that you’re going to create because you don’t want to just go out there and create an LCD and then potentially not close on the property is any then you paid for L. C. went through all the set up that you don’t even need so I write our purchase contracts that way to be purchased by your name my case Tim Hubbard and or assignee and then that way we can add that L. C. name really it kind of in that like the last moment or a couple weeks before closing and your lender again we’ll let you know when they need all the paperwork on that now for forming an LLC it’s gonna have different costs depend on where it’s at California for example 800 Bucks probably the most expensive one while me and I want to say is like 150 Bucks or less in these per year and dismembered you have to renew it each year too but you also have to keep separate books any expenses that go into the L. C.. You can’t co mingle them and co mingled means using your personal financial your personal funds and co mingling with the L. L. C. so if you’re forming an LLC to hold the properties you gotta make sure all the expenses and all the income go through that L. C. and then you also have to consider that you’re gonna need to separate out on your tax returns as well so just a couple things to consider their most of the time Elsie’s are not difficult to set up you can have a lawyer do it now or you can jump online for whichever state you’re in and most of time you can set it up right online as well kind of a a side benefit cool thing to have in separate L. seizes it you can also start business credit so what I like to do is when I open a new L. C. put the property underneath that I opened its own bank accounts with separate I use quickbooks online and saw the quick book files are linked with the different L. season and that way if you make a charge on a company credit card business debit card it goes right into the appropriate quickbooks file so that’s how I set it up but yeah you start business credit insulator down the road you can use that business credit and it’ll be separate from your personal credit. So that’s kind of just a a side benefit there so the main reason we want to have an LCD is to protect ourselves from this super super litigious environment that we’re living in I have not been in a lawsuit luckily knock on wood but we do these things to protect ourselves in case that happens so. Consider using L. C. ice set the benchmark at like $1000000 in property now in total property value not neck witty and that’s just my benchmark because there are other things we can do to protect ourselves without having to form that L. C. an umbrella policy is a great idea after your insurance so first of all we wanna make sure rules are set up right for short term properties we have deposits we have the appropriate insurance and then also an umbrella policy on top of that and with with those things that you’re pretty well protected and that’s why I use that $0 price point as a benchmark to start forming LLCs after that because a lot of times these things that we’ve already set up my car insurance and hopefully you have an umbrella policy that’s going to cover it up to $1000000 and for a little bit more you can get on broad policy that covers you up to $2000000 if you have commercial property so 5 units or more they require most of the time commercial liability policies which also cover you up to 1000000 or $2000000 so just evaluate your insurance and take a look at the umbrella policies and then keep in mind that if someone did sue you let’s say they slipped on your property and your property is worth 500000 but you still owed 400000 on it well then they could only go after your equity they could only go after that 0 and everything else that is under your personal name if that property was in your personal name but you want to go the extra step. LLC is not a bad idea at all just check with your lender to make sure that they will allow you to transfer your property into an LC if it’s one you already own and if it’s one you’re requiring check with them up front so you know that you could buy it under an LLC there are some other structures and entities out there that you may hear a lot of people recently you’re talking about series L. L. C.’s which is just one more way to separate your personal information from the business or the property and that’s one of the main benefits by the way of having L. C. is it you can keep your name anonymous while mean for example does not disclose your personal name on the L. C. which is why so many people prefer to use while analyses so every state’s different and the series L. sees you know I looked into that for a while it was very expensive to to set it up I want to say it was like 10000 Bucks just to start the structure and I didn’t see huge benefit to it aside from the way I already had things set up but I’m not an expert on that so the best way is just to talk with an asset protection tourney that’s really the best way and they will give you a good rundown so consider putting your property an LLC but just make sure to check on a couple of those things that we mentioned before you do and if you haven’t yet if you could please head on over to iTunes or stitcher or Spotify wherever you’re listening to the podcast leave us a review and subscribe it would be greatly greatly appreciated all help other people find podcast so we can keep coming out with them every Tuesday so until next time. You have a wonderful day. Want to get on the fast track to financial freedom through short term rentals what all searching the properties you. You want to make sure that you fire the right properties I want to give you my. Yes that there is no charge to you for being one of our subscribers just the rest methods.com R. E. S. T.. .com.